Tech Labour Market Outlook in 2024-2025

After the total surge and overheated markets of 2021, a fairly pessimistic mood has set in, intensified by recession (or rather, the anticipation of it), widespread layoffs, and staffing issues in most companies. These market conditions underscore the need for a strategic approach to talent acquisition and employer branding.

To strengthen in the next 2–3 years and build strong employer branding, deep understanding of the market is imperative. This article aims to provide a detailed analysis of the current state of the tech talent market, examining geographical trends, technological advancements, and in-demand positions. You will gain insights into salary trends and the overall directional flow of the market.

Global Geography of Developer Participation

According to StackOverflow Developer Survey, the USA, Germany, India, and the UK are at the forefront in terms of developer participation. There is also a noticeable rise in participation from Latin American countries.

Top 10 locations (StackOverflow):

- USA – 21.21%

- Germany – 8.34%

- India – 6.4%

- UK – 6.32%

- Canada – 3.99%

- France – 3.34%

- Poland – 2.77%

- Netherlands – 2.71%

- Australia – 2.36%

- Brazil – 2.32%

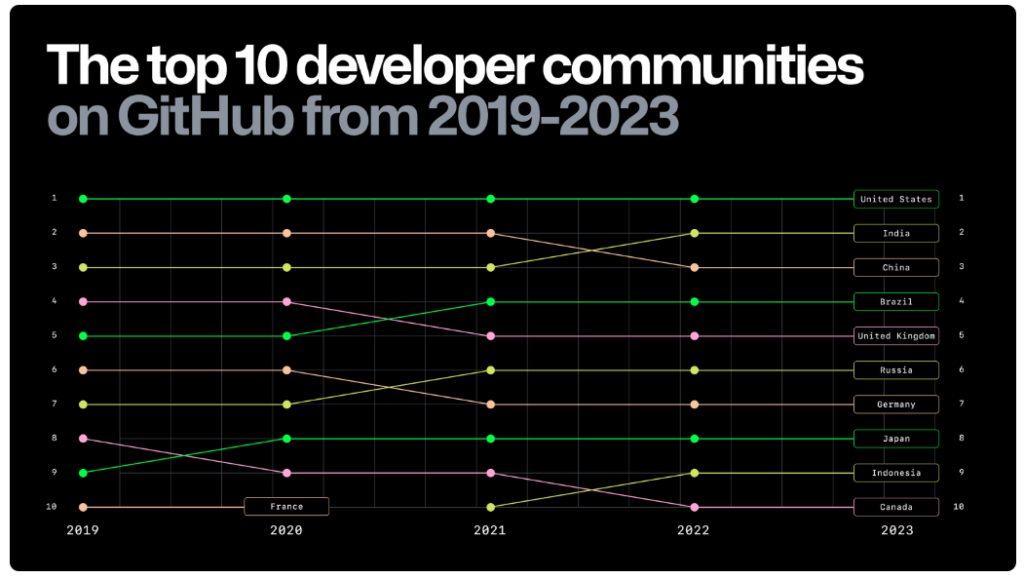

GitHub’s community activity data reveals that China, along with the United States and India, ranks in the top five, with Brazil also showing a significant presence.

In Europe, the top three countries with the strongest developer presence are Spain, Portugal, and Poland. For the Asia-Pacific (APAC) region, Singapore, India, and Hong Kong lead the way. In Africa, Nigeria, Ghana, and Kenya are the prominent countries in software development. Meanwhile, in Latin America, Argentina, Bolivia, and Colombia are at the forefront of the tech talent pool.

The Developer Profile and Technologies

In terms of programming experience StackOverflow’s survey reveals that 48% of respondents have less than ten years of coding experience. Interestingly, Australian and British developers appear to be the most experienced, with an average of 17.5 and 17 years of experience, respectively.

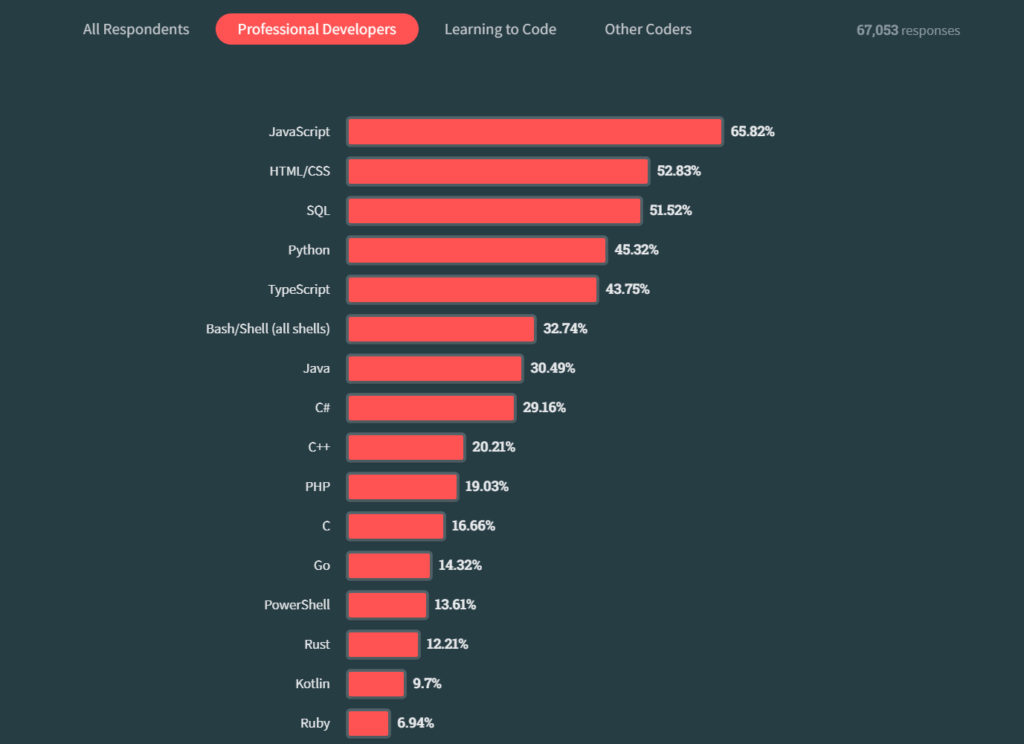

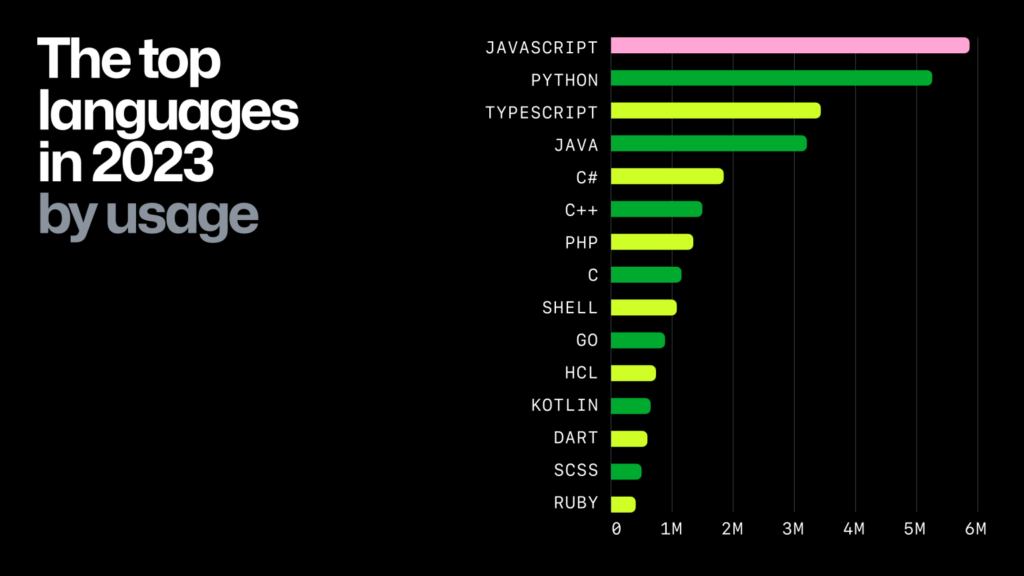

For an insightful overview of the current trends in programming languages, refer to the following charts:

2023 Global Salary Trends in Tech Labour Market

In 2023, Zig has emerged as the highest-paid programming language, surpassing Clojure, which experienced a 10% decline in average salaries from the previous year. Additionally, Dart and SAS have seen the most significant salary growth, each recording over a 20% increase compared to 2022, according to the Stack Overflow 2023 report.

Globally, average salaries have increased by 10%, with a slightly higher rate of 11% among cohorts of professional developers. Below are detailed salary data for specific programming languages (annual salaries for 2023 vs. 2022 indicated in brackets):

- Ruby: $98.5k vs. $93k

- Go: $92.6k vs. $89.2k

- Rust: $87k vs. $87k (no change)

- Python: $78.3k vs. $71.1k

- JavaScript: $74k vs. $65.5k

- Java: $72.7k vs. 64.5k

- Solidity: $72.6k vs. $70.3k.

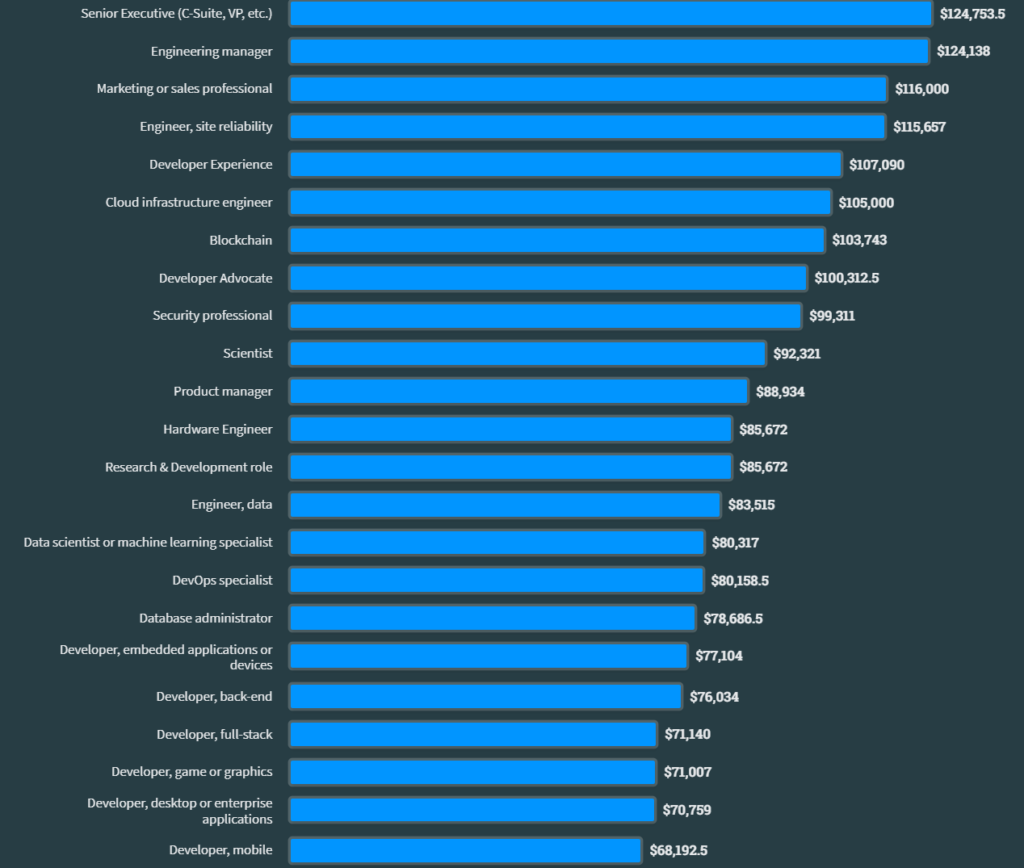

Salaries by Developer Type

Senior executives and engineering managers generally command top salaries. In Germany, for example, engineering managers earn salaries comparable to senior executives.

The Demand for Tech Talent

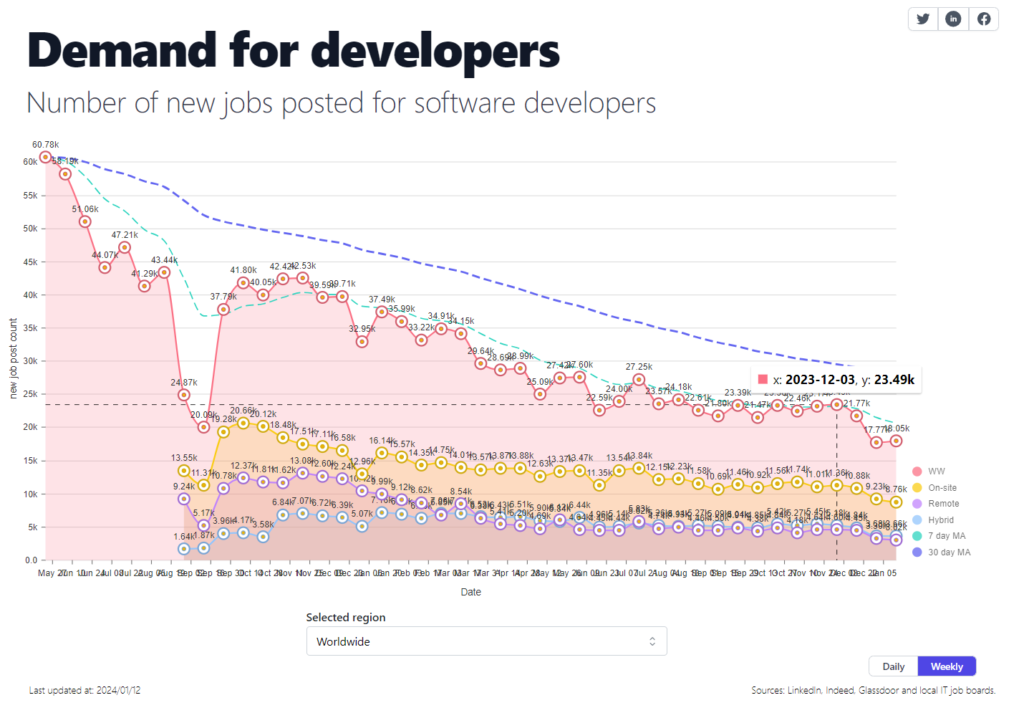

Despite a gradual decrease in job openings for tech talents, a nuanced understanding requires examining two studies:

- DevQuarterly’s ongoing monitoring of job vacancies for Software Developers. In May 2022, there were 60.78k job openings, which decreased to 18k by January 14, 2024 – a 3.37-fold decrease.

- McKinsey’s analysis of technology trends highlights an overall decrease in job vacancies (-13% in 2022 vs. 2021) and an increase in vacancies in trending sectors (+15% in 2022 vs. 2021).

“Trending” sectors, those with high expectations for technological and business development in the coming decades, as identified by McKinsey, with the percentage increase in job vacancies in 2022 vs. 2021, include:

- Applied AI (+6%)

- NextGen software development (+29%)

- Cloud and edge computing (+12%)

- Trust architectures and digital identity (+16%)

- Future of mobility (+15%)

- Electrification and renewables (+27%)

- Climate tech (+8%)

- Advanced connectivity (+7%)

- Immersive-reality tech (+10%)

- Industrializing machine learning (+23%)

- Web3 (+40%)

- Space technologies (+16%)

- Generative AI (+44%)

- Quantum technologies (+12%)

Despite widespread layoffs, the majority of developers maintain steady employment, whether permanent or contractual (StackOverflow, 2023). Among professional tech specialists, only about 3% of developers are unemployed.

Talent Demand Across Positions and Technologies

According to DevQuarterly, in the U.S., Java and C# / .Net dominate job listings. From December to January, there has been an increase in positions for React and Android developers, while Python fell from the third to the fifth rank in demand.

The most sought-after roles are in Full-stack, Backend, and Frontend development. The UK shows a similar trend, with higher popularity for Python and a noticeable demand for mobile developers and DevOps, though on the decline. See more details here.

Talent Shortage vs. Waves of Mass Layoffs

The coexistence of a tech talent shortage and mass layoffs may seem paradoxical. Furthermore, the shortage of tech talent persists despite new rounds of layoffs.

Layoffs

In 2023, over 260,000 tech sector employees were laid off worldwide, a 1.59-fold increase from 2022. Reasons include:

- HR budget optimization. Gartner research revealed that companies involved in the top 10 IT technology layoffs still employ 150,000 more people than at the beginning of 2020.

- Increased process efficiency and automation.

The best illustration of this ‘excess staff purge’ is found in the continuously updated TechCrunch report, detailing where and how top companies are implementing layoffs.

Notably, many of the layoffs from 2023 to early 2024 affected public companies, where there is additional pressure from shareholders aiming to lower expenses and increase the company’s stock price and profits.

New Wave of Layoffs: In January 2024, layoff reports surged, with companies such as Pixar, Discord, Google, Amazon, Twitch, Duolingo, Unity, and others announcing cuts.

Layoffs.fyi statistics over 3 years:

- 2022: 1064 tech companies w/ layoffs – 164969 employees laid off

- 2023: 1186 tech companies w/ layoffs – 262582 employees laid off

- 2024: 48 tech companies w/ layoffs – 7528 employees laid off

Talent Shortage

In the face of widespread corporate downsizing, companies continue to seek highly skilled technical professionals for key projects, particularly in specialized areas such as AI, Data Science, Security, and IoT. Interestingly, many of those being laid off held business roles rather than technical positions, although AI/ML/DS experts were not immune to the trend during peak layoff periods.

Deloitte’s 2023 report notes that nearly 90% of executives face significant challenges in talent acquisition and retention. In the U.S., 54% of business owners attempted to hire new employees in November 2023, with 93% facing a scarcity of qualified candidates (NFIB, 2023).

Over 40% of British employers struggle to fill positions (CIPD, 2023). The net employment balance remains positive at +26, indicating a general trend towards workforce expansion.

For the first time since the winter of 2021/22, the intentions of employers to reduce their workforce have decreased, with only 17% planning cuts by December 2023.

The talent shortage is further complicated by broader global factors:

- The traditional path of Computer Science education is being bypassed by many candidates who choose to self-learn programming, which raises concerns about the depth and quality of their knowledge.

- Additionally, the polarization of requirements is evident, with companies setting high standards for candidates while candidates themselves have substantial salary expectations, making it more challenging to reach a consensus.

Compromising Quality: The Hidden Impact of Talent Shortage

The talent shortage has led to some companies hiring software developers who are actually underqualified candidates.

In the U.S., only 29.4% of software architect applicants and 39.6% of DevOps job candidates fully meet employer requirements, leading to over 50% of companies hiring technical staff despite these mismatches (Grid Dynamics, 2023).

In Demand Talent: The Paradox of Not Hiring

In the current job market, another paradox exists: a multitude of unfilled positions alongside a wealth of ready-to-work professional talent.

This situation primarily stems from layoffs, but there are two other key factors: flawed recruitment processes and uncertainty. Despite numerous strong candidates applying, companies often refrain from hiring them. The issues typically include:

1. Caught in the Recruitment Filter

Recruiters overlook top candidates, relying heavily on automation and AI for initial candidate screening without manual verification. This approach is surprisingly problematic. Consequently, platforms like LinkedIn and Reddit frequently feature threads like, “I applied via an HR-bot and got rejected within seconds.”

2. Broken Recruitment Processes

Even when encountering suitable candidates, companies often delay decisions. This hesitancy is not just about holding out for a better candidate. Sometimes, there’s a lack of direction or feedback from the hiring manager, or the job vacancy is in a semi-frozen state: candidates are considered, but there’s no certainty about making a hire. This indecision is partly due to a reduced planning horizon over the last 2-3 years, with companies being unclear about market expectations in the coming months or quarters.

Almost half (44%) of companies fail to respond to candidates within four weeks of receiving their applications (Resource Solutions, 2023).

3. Underestimating Candidate-Centricity

Surprisingly, companies often fail to prioritize candidate interests. Despite withholding salary details in 95% of job postings, they expect candidates to provide extensive personal information, highlighting an imbalance in information disclosure. Furthermore, three-quarters of online job applications require creating a new account, typically doubling the application time (UK Data, HR Magazine, 2023).

What to Expect in 2024 – 2025: Is the Tech Sector at Risk?

The global job market’s outlook for the next few years is challenging. A Jobvite survey in 2023 indicated that 57% of HR professionals expect difficulties in hiring over the next 12 months, mainly due to a lack of tech recruiters, recruiting resources, proper solutions for recruitment, and an increase in employees leaving organizations (North America Data).

In contrast, expectations for the technology sector appear more optimistic.

Comparing global, U.S., and tech-sector unemployment rates, we observe the following:

- The global unemployment rate fell to 5.1% in 2023 and is expected to rise to 5.2% in 2024 (ILO data).

- The overall unemployment rate in the U.S.: 3.7%.

- The unemployment rate in the U.S. tech sector: 2.3% (U.S. Bureau of Labor Statistics in adaptation by CompTIA, 2023).

Analyzing macro forecasts for the IT industry is revealing. These predictions offer a glimpse into the overall dynamics of the Tech talent market, which show a stable correlation.

Despite initial expectations of slowed IT investment in early 2023, the years 2023 and 2024 are marked by significant increases in IT spending and budgets.

IDC reports that IT spending remains resilient despite economic pressures, particularly on servers, data storage systems, software, and services.

Expectations for technological growth in 2024 include:

- According to IMARC Group, the global AI market reached $92.6 billion in 2023, with projections to hit $737.1 billion by 2032, growing at an average annual rate of approximately 25%.

- Gartner forecasts IT spending to increase to $5.14 trillion in 2024, 8.8% more than in 2023. The most significant growth is expected in software and IT services, with a focus on cloud technologies, particularly Infrastructure as a Service (IaaS), which is expected to grow by 27%.

- In 2024, the three largest developed countries in Europe – the UK, Germany, and France – will account for 51% of total IT spending.

- Cybersecurity investments are expected to rise (80% of executives plan to increase spending). European spending on security and risk management is predicted to reach $56 billion, 16% higher than the previous year.

Expectations by Locations

The GitHub report (see the chart below) sheds light on emerging markets (e.g., APAC, LatAm) potentially overtaking traditional leaders by 2028. India is likely to soon emerge as a leader, while Indonesia and Japan are expected to strengthen their positions. Vietnam might enter the top 10 within the next four years.

Due to the war initiated by Russia, its market share in almost all industries, including the developer sector, is declining. Germany and the UK are expected to face the most significant market share losses by 2025-2026.

Will the Tech Talent Shortage End Soon?

The current demand for technical talent significantly outstrips supply, and Gartner anticipates this trend to persist at least until 2026, based on projected IT spending.

According to the Bureau of Labor Statistics, by 2026, the U.S. will face a shortfall exceeding 1.2 million software developers. Additionally, 545,000 current software engineering professionals are expected to exit the industry by then (Source: BLS).

Over the next decade, STEM job opportunities are projected to grow by 10.8%, with computer technology, engineering, and advanced manufacturing leading the way. Employment opportunities for software developers, quality assurance analysts, and testers are forecasted to increase by 25% from 2022 to 2032, marking the highest growth rate among all professional groups (Source:BLS).

Staying informed about market trends is crucial. However, doing this independently can be time-consuming and resource-intensive.

If dedicating time to continuously monitor market salary rates and other indicators for salary benchmarking is not feasible, partnering with professional market analytics providers is a wise move.

Conclusion

The difficult times for the Tech industry are not over yet. Amidst new waves of cutbacks, the talent shortage persists. However, this will not halt the progress of the tech industry, especially with breakthroughs in specialized, knowledge-intensive technologies and AI.

Tackling the ‘talent crunch’ now requires localized efforts by individual companies.

To address this, businesses must understand the specific dynamics of the tech talent market and actively work to find and retain professionals. The minimum goal for each business is to survive and grow over the next few years, by which time market conditions are expected to improve significantly.