Global Tech Workforce Hubs Of The Future

According to research conducted by Korn Ferry, there will be a global shortage of more than 85 million tech workers by 2030. This shortage will account for an $8.5 trillion loss in annual revenue. Looking at the European landscape, a recent report by the European Commission found that there are currently over 600,000 IT workers short on the old continent, not even counting other tech sectors. This gap will not be filled either by new generations or through migration. It has obvious consequences – a constant struggle for workers, a slowdown in business development and increased demands from employees, including ever higher salaries. Companies have one option – they have to source their employees from other parts of the world, including developing regions. This, however, is not an easy task. Emerging markets and their workforces face insufficient education, financial difficulties and digital exclusion, poor infrastructure – inadequate internet network or lack of language skills. There are, however, regions that are already intensively transforming the current situation through a series of investments turning them into black horses on the map of future global tech workforce hubs. Some of these are being recognised more and more today, and others we will hear about in a few years. We present the countries around the world that are about to become real tech talent hotspots.

AFRICA

There is no doubt that Africa has sheer unimaginable potential.

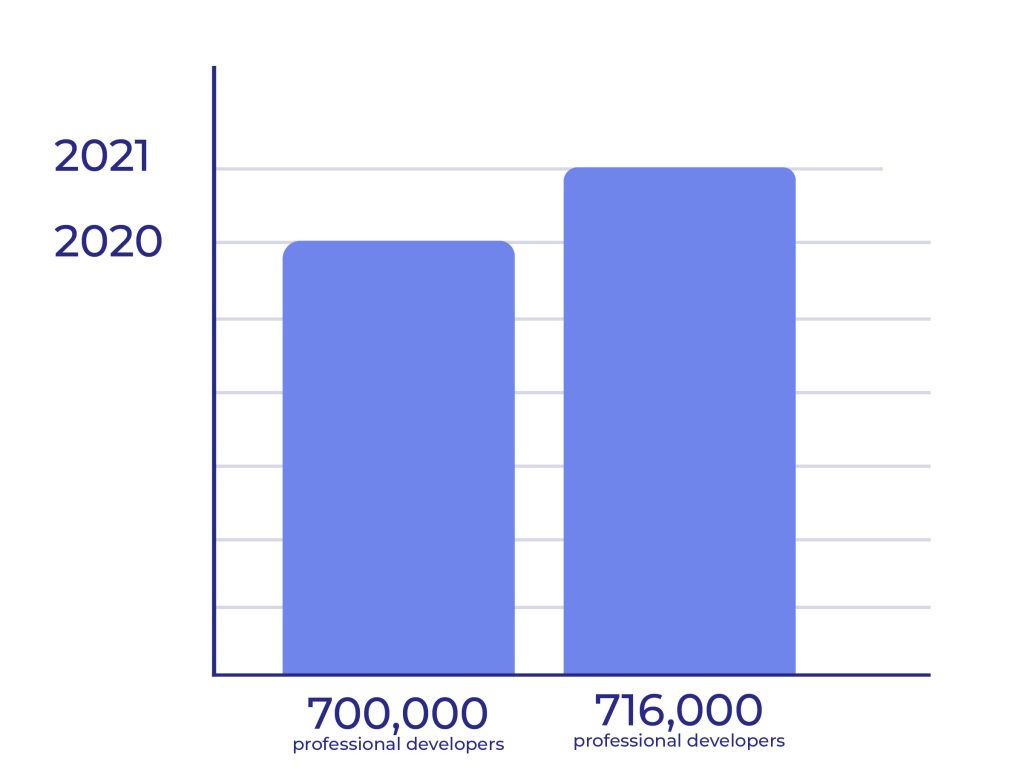

Huge possibilities are visible only by looking at the continent’s demographics, as it has the largest concentration of young people in the world, according to the UN. The share of Africa’s youth in the world is expected to reach 42% by 2030 and more than double from current levels by 2055. Economic indicators confirm this enormous potential. The region has rapidly become the second largest mobile market in the world, revolutionising access to financial services, public health and the internet. The fourth industrial revolution is visible here like nowhere else. Tech talent in Africa is at a historical peak and continues to rise. “There are nearly 700,000 professional developers across Africa with more than 50% concentrated in five key African markets: Egypt, Kenya, Morocco, Nigeria, and South Africa”. Young people are seizing these opportunities and in many parts of the continent, we can observe an unprecedented boom of emerging entrepreneurs. This operates in synergy with governments’ economic transformation efforts and puts the continent in the spotlight of the global tech industry. Google’s Africa Developer Ecosystem 2021 Report proves this: in 2021 the pool of professional developers increased by 3.8% to the total number of 716 000 professionals. Although 46% of the workforce are juniors, already 38% are working for at least one company outside the continent.

Despite the recent slowdown in development, Africa is still being closely watched as the next big growth market. This region has strong prospects, especially for European companies due to the lack of significant time zone gaps.

Which countries are worth paying extra attention to?

South Africa is well established in the developer landscape and its position as a leader remains unchanged. It is chased by Egypt, Nigeria and Kenya, which have a large developer population, flourishing startup ecosystem with a strong funding environment, and stable socio-economic conditions. Nigeria and Kenya are home to a variety of large software skill training providers, while Egypt relies more on its robust government-sponsored universities and global online coding programs. With this support, offered mainly by Andela, Decagon, and Moringa, Nigerian and Kenyan students have access to strong learning programs.

Nigeria

Nigeria emerged as a hotspot for developer talent in 2021. The country continues to transform its digital landscape, unlocking more opportunities for IT professionals who specialise mainly in front-end, back-end and full-stack web development. As of 2021, there are currently 114,536 developers in the country, which is 556 IT talents per million population (Ernesto Spruyt, 2021). Nigerian professionals are pioneering API-based financial services and open banking, which has led to a fintech boom across the region. Lagos, Nigeria’s capital and Africa’s largest city, dubbed “Africa’s Silicon Valley”, is home to large tech communities, such as in the Yaba district. According to the 2019 Partech Report, Fintech and EdTech account for the majority of the country’s technology growth. The technology sector contributed 15% to Nigeria’s GDP growth in 2020, second only to agriculture. Nigeria also has the largest population of English speakers in Africa (over 79 million).

Kenya

According to a Harvard Business Review report, Kenya has a growing, tech-savvy ecosystem and it’s home to what’s known as a “Silicon Savanah” in Nairobi. Thanks to the popularity of M-Pesa, the mobile payments capability offered by Safaricom, over 70% of Kenyans have a mobile money account, and over 75% of Kenyans aged 15 or older made a mobile payment in the last year. During the past decade, Kenya has advanced quickly as a hotspot for some of the continent’s most innovative digital enterprises, such as Ushahidi, M-KOPA or M-TIBA. There are 200 digitized services offered through Huduma E-Centers countrywide and a comprehensive online government-to-citizen services platform, eCitizen. Kenya’s policymakers have enabled a favourable regulatory environment, and have promoted a high use of digital payments.

It is also worth looking at countries that will only be rumoured about in a few years’ time.

Morocco, Rwanda & Ghana

These countries are fostering a landscape for growth. They have a moderate-to-large developer population, a mid-late-stage startup and technology ecosystem, and a moderately stable economic environment.

Rwanda is undertaking numerous efforts to transform itself into a digital hub, e.g. Irembo, an e-portal of government services for citizens, high usage of mobile accounts, expanding 4G coverage throughout the country and improving digital skills. Examples of the potential include Rwanda’s Mara Group, the first smartphone manufacturer produced entirely in Africa.

In terms of education programs, digital ecosystems are improving. Some regional providers operate locally, including NIIT in Ghana. Moreover, these countries aim to boost domestic-led opportunities. For example, the Rwandan government opened Rwanda coding academy for software and web development skills training. Other indicators are also supporting the forecast. According to a recent report by McKinsey, Ghana is set to lead growth in Africa’s fintech sector, with the country projected to experience a 15% annual growth rate until 2025.

Tunisia, Ivory Coast, Algeria & Senegal

These are emerging developer landscapes. The countries are now establishing the foundation for growth in the following years. The developer population is small-to-moderate, the startup ecosystem is in the early stage, and the technology ecosystem is improving. Coding schools and bootcamps are still not popular. Due to the lack of other funding, some academies have been opened as EdTechs in collaboration with private companies like Orange Digital Center and Sonatel Academy. Traditional universities and schools dominate the ecosystem.

ASIA

Asia is an extremely diverse region and it is difficult to describe universal trends without distorting the true picture with generalisations. India and China are well established in the software development outsourcing market. The shares of other countries in the south of the continent are also growing intensively. This is primarily because of low operational and labour costs.

Other countries are popular because of the unparalleled level of development of the workforce and the overall economy, including the tech industry. Such regions include the small island states, which have developed their economies extensively over the years based on trade relations with the USA and the UK. Singapore, Hong Kong and Taiwan rank highly in the 2021 Global Talent Rankings, alongside developed European countries. In addition, Hong Kong is ranked 2nd and Singapore 5th in the Digital Transformation Index 2021.

KPMG’s survey reports that Singapore takes the top spot as a potential world-leading technology hub. The country is viewed as the best alternative tech hub to Silicon Valley. It’s worth adding that Singapore is making a heavy push toward reskilling and upskilling its workforce to meet market expectations and the demand for tech talent.

However, Asia is also hiding less obvious pearls that could become global centres of tech talent in the near future. Which regions are we referring to?

Philippines

The Philippines presents a strong position as a solid source for companies seeking tech talent. The country has a strong educational background. According to the Harvard Business Review report, it produces around 130,000 IT and engineering graduates yearly. In addition to state education, there are also training programmes led by private corporations such as Google. The internet is present throughout the country. As of February 2022, the Philippines has 79.66 million Internet users and a 72.7% Internet penetration rate according to Statista.com.

English proficiency is high, ranking 2nd in Asia. The government makes efforts to develop the country’s position in the regional and global arena, also by establishing a National ICT Ecosystem, anchored in five independent pillars, including talent development and professional skills. The audience is recognising this. Gartner’s Emerging Talent Hubs for IT in 2022 report showed that the capital city of Manila is among the top five global IT hubs with a score of 6.1 and a technical talent supply of more than 174,600 professionals. Filipinos are skilled in various programming languages (e.g. Java, Python, Ruby, PHP, etc.). Programmers come at a cost that is sighttps://www.gartner.com/en/human-resources/research/talentneuron/emerging-talent-hubs-for-itnificantly lower than those from Eastern Europe and even India.

Vietnam

Vietnam’s tech talent pool has been growing exponentially in recent years. The country’s universities have invested substantially in STEM education, resulting in world-class programmers. Around 80,000 IT graduates are entering the market annually (TechInAsia, 2019), while Computer Science and Engineering comprise as much as around 60% of all bachelor’s degrees awarded in the country (Skuad, 2020). With the release of recent government policies to boost technology and education investments, Vietnam is gradually transitioning to an outsourcing destination for business services requiring high-skilled talent and has the potential to become the next BPO giant. Young people (15-35 years old) make up the majority of the Vietnamese population with more and more of them having very good English. All this makes Vietnam ranked 6th in Kearney’s 2021 Global Services Location Index, which identifies the best places to source talent.

Indonesia

It is the real rising star of the region’s tech constellation. Indonesia is forecast to be the largest online economy in Southeast Asia by 2025 (AHK Indonesien, 2021). Academic education is certainly contributing to this process – Indonesia has several education and training institutions that are creating a strong talent pool for the tech and startup market. Cambridge International points out that Indonesia, of all countries in the world, has the highest number of students using technology in learning. In addition, the government has a plan to grow the economy through AI, which is reflected in public and private investment.

Thailand

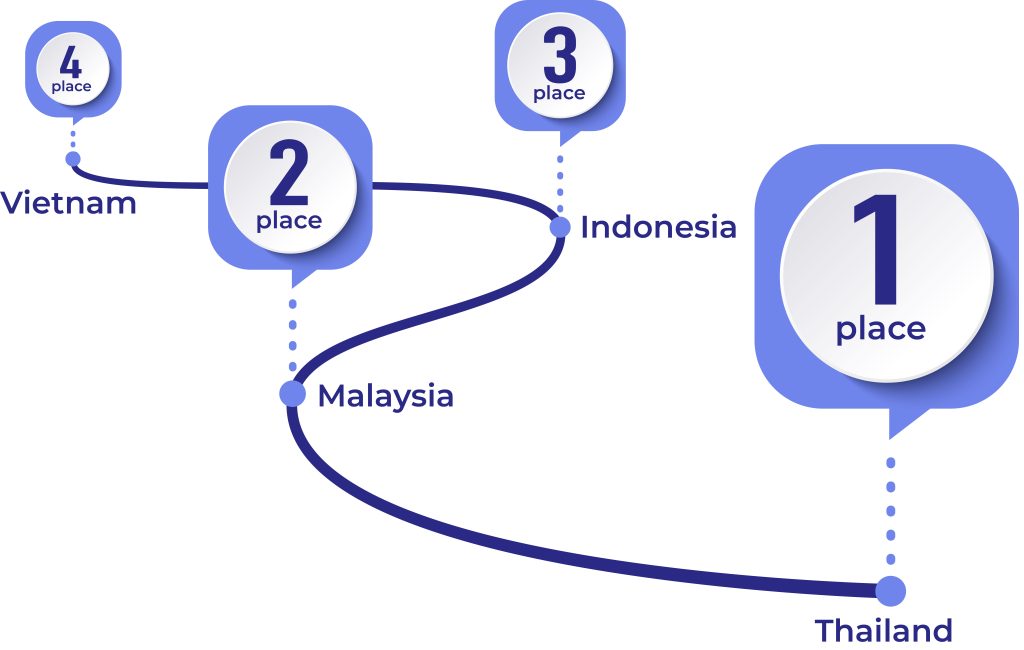

Thailand’s attractiveness is the result of several activities at the government level. It focuses on development based on Thailand 4.0: a plan to turn into a new value-based economy by adopting green and smart technologies. The emphasis is on growth in Robotic Process Automation (RPA), Blockchain, and Internet of Things (IoT), as well as nurturing data scientists and IT professionals, mainly in fintech, biotech and food technology. Government institutes nurture technical education. More than 24 universities provide development opportunities for an average of 7,000 graduates in technological fields per year. In the 2019 poll, Thailand topped the list in terms of attracting R&D and technical professionals across the ASEAN zone (NIKKEI Asia, 2020), with Malaysia in 2nd place, Indonesia in 3rd and Vietnam securing 4th place. This is why the country is attracting tech headhunters around the globe.

Malaysia

Malaysia has been the region’s technology hotspot for some time now. This can be clearly seen in the figures: 80% of the population has access to the internet and the technology sector accounts for more than 18% of the Malaysian economy, one of the highest percentages in the world (TechTarget, 2019). The growth of the technology sector did not happen overnight but was the result of a 20-year plan by the Malaysian government focusing on the IT and communications sector. The federal monarchy has also had a long-standing focus on education – in 2013, it adopted the Malaysian Education Plan, which emphasised the adoption of technology in providing a world-class education to its students. Thus, Malaysian academic institutes have dedicated infrastructure such as state-of-the-art computer labs, high-speed broadband and holistic technology-based learning environments. As a result, young people are seeking education and career opportunities in fields such as IT, AI and IoT, and fintech. The private sector is also getting involved in education, for example, the Huawei ASEAN Academy plans to train 50,000 digital talents in Malaysia from 2021 to 2025, averaging 10,000 new experts a year. Such an environment is ideal for developing a valuable pool of tech talent that draws the attention of companies looking for remote workers.

Pakistan

Pakistan will be increasingly buzzed about in the coming years. As the global market turns into freelance, the country is one of the fastest-growing in the freelancing world, and there is a significant pool of talent open to work in the tech industry.

Pakistani IT professionals specialise in areas like Databases, Distributed Systems and prefer to work in C++.

SOUTH AMERICA

By 2021, Latin America was the fastest-growing region in the world in terms of venture funding (Crunchbase Report). In any case, the entire technology industry is developing extremely rapidly. Education is thriving, with 739,000 new tech graduates a year. This translates into an abundance of new startups and established companies expanding their operations, and continued growth with a concentration of experienced technology professionals across the region. According to Statista, Brazil ranks in the top 10 and Mexico in the top 15 countries worldwide in terms of the number of unicorns. These startups are making their mark on the economy of the entire Latin American region and are playing an important role in digital transformation. In addition, Brazil, Mexico, Argentina and Colombia are the largest concentrations of developers on the continent (Robert Grootjen, 2021). They have an established position as outsourcing hubs, mainly for US companies. Argentina boasts more than 20,000 STEM graduates annually. According to EF English Proficiency Index, Argentinians scored the highest among all Central and South American countries. CBRE ranked the country’s capital fourth in Latin America’s 10 largest markets in 2020 estimating tech employment at 86,722. Buenos Aires also ranked first on Gartner’s talent list for emerging IT talent centres. Contributing to this is the plethora of innovative companies and start-ups that are growing technology talent.

Although wage rates in South America are higher than for example in Asian countries, the region has undeniable advantages. US business chooses LatAm because of the minimal time zone difference between the US and Latin American countries. This allows for shorter response times between teams and highly synchronised communication, enabling quick problem-solving. The closely aligned cultures on both continents, such as the same holidays and public holidays, also facilitate work.

The huge potential of Latin America is also found outside the largest countries, and it is worth taking a closer look.

Costa Rica

Its strength lies in education. Costa Rica has some of the best universities in the western hemisphere, producing 7,000 technology graduates a year. It has a stable government, a high level of investment in technology and is an ideal choice for many global organisations as a technology centre. The government is working with the private sector, for example through the Talent Up project between CINDE and the Ministry of Labour and Social Security. This programme has trained people experiencing unemployment with work-ready skills, resulting in almost 7,000 Costa Ricans receiving training in in-demand areas such as software development, customer service, technical support and intensive English. Familiarity with the latter and similar time zones predominate the country’s attractiveness to US companies in particular. Costa Rica has recently been identified as an emerging market for technology talent, as more than 20 Fortune 100 companies, including Intel, IBM and HP, have set up development centres there.

Chile

Chile is investing in digital transformation like hardly any other country. Minister of Economy, Lucas Palacios, states: “Chile is the Latin American country that invests the most per capita in information technology”. A recent Accenture study indicated that the digital economy accounts for more than 22% of the country’s GDP, ranking Chile first in the Digital Economic Value Index in Latin America based on the level of adoption of digital technologies, accelerators and digital talent. The IT industry grew by 6.3% in 2020. Chile has the highest internet penetration in Latin America, with 76 per cent of the population being regular users. What’s more, the country launches the region’s first 5G network in 2022. This provides the perfect breeding ground for tech talent. Chile ranks second among Latin American countries experiencing the highest digital growth. The country’s capital, Santiago, has the third highest availability of digital talent in Latin America, second only to São Paulo and Mexico City. What do they specialise in? According to Coursera’s Global Skills Report 2020, Chile is the second country in the LatAm region in Data Science with the best performance in data visualisation. The Data Science ranking was built on competencies in technologies such as Python, SQL, R, Cloud APIs, and NLP.

Uruguay

The country has been taking care of the fundamentals for a long time. It was one of the first countries to promote the ‘One Child One Laptop’ policy, resulting in more than 30,000 students having access to advanced subjects such as robotics and computer science (WorldBank, 2012). This also has helped to popularise STEM subjects among students. Learning and working are underpinned by excellent infrastructure. Uruguay has a high internet penetration rate of 83.4% and one of the fastest download speeds in Latin America. Almost all homes and businesses have access to high-speed internet connections, 75% of which have access to fibre optics. This translates into global recognition. Uruguay is a member of Digital Nations, a collaborative forum of the world’s most digitally advanced governments. The forum currently has 10 members, such as Canada, Israel, Denmark and New Zealand, who promote digital inclusion and accessibility, open government and digital citizenship. Uruguay also ranks 1st among countries in terms of e-governance in Latin America, according to the United Nations. The country is the second most digitally ready country in LatAm (after Chile) according to the 2019 Cisco Global Digital Readiness Index. The report measures the level of digitalisation, competitive advantage and boosts to economic growth. Uruguay’s tech exports amounted to US$1.5 billion a year, indicating that tech talent is very much present there. As a result, this Latin American country has become one of the hottest destinations for technology hires.

CONCLUSION

Why should you hire talent from other countries? Financial reasons and insufficient numbers of professionals on the market are certainly not the only factors.

Multinational teams, on the surface, can be a challenge, especially when it comes to cultural or language barriers. These difficulties, however, become insignificant when weighed against the potential benefits.

A huge and still underestimated asset is precisely the differences in mindset. An international team can approach challenges in a more creative way and often solve problems faster, due to the diverse experience and mentality of their members from different backgrounds.

The second argument is related to expansion and growth plans in new markets. Hiring talent from the regions where the company intends to grow its business gives an immediate advantage – you gain an insider who knows the realities well, has knowledge and experience of working in that country and is an invaluable know-how source. They can protect the company from many unforeseen setbacks and point to easy solutions that you would not be able to come up with on your own.

This strategy is used by a great many companies, including the biggest players in the tech market. Progressive companies have already opened representative offices in many regions around the world and are optimising operations with multicultural, international teams. While other organisations are still hesitating and wondering in which direction it is worthwhile to expand, and whether it is even worth attempting to build remote teams, progressive businesses are fine-tuning processes and reducing costs by picking up the best talent from emerging markets. It is worth following their example and exploring this development trajectory.

Sources:

- https://arc.dev/employer-blog/argentina-engineering-team/

- https://asia.nikkei.com/Business/Technology/Singapore-tech-companies-vie-with-Thailand-for-region-s-talent

- https://assets.ctfassets.net/p8xsnnoeyh42/4lfLMna2XpfMqECin7BxX1/5b06696ffffbb5a3aa4c3848b3b0faf2/3_

Reasons_Why_Africa_is_the_Next_Global_Outsourcing_Hub.pdf - https://biz30.timedoctor.com/outsourcing-to-asia/#the-top-5-countries-for-outsourcing-to-asia

- https://cdn-website.partechpartners.com/media/documents/2020.01_Partech_Africa_-_2019_Africa_Tech_VC_Report_FINAL.pdf

- https://data.worldbank.org/indicator/SE.XPD.TOTL.GD.ZS?end=2013&start=1970

- https://globalpeoservices.com/top-7-countries-for-hiring-tech-talent/

- https://hbr.org/2019/12/research-how-technology-could-promote-growth-in-6-african-countries

- https://kstatic.googleusercontent.com/files/f921919199e8543ce5ba3925e4ddbc6d104fe2e995c7f3338a6d88554890

372ca442a6a23c9a17f94e06b143eba71d4652cbea529d4e2b6b5646da8f46736615 - https://restofworld.org/2021/tech-hubs-lagos/

- https://terminal.io/learn/the-best-countries-to-outsource-software-development-in-2022

- https://www.cbre.com/insights/books/scoring-tech-talent-2022/09-where-else-is-tech-talent-headed

- https://www.computerweekly.com/news/252462116/How-technology-is-shaping-Malaysias-economy

- https://www.freelanzing.com/index.php/216-alexa-rank-01-01-2021

- https://www.imd.org/centers/world-competitiveness-center/rankings/world-talent-competitiveness/

- https://www.kzsoftworks.com/blog/how-did-uruguay-convert-into-an-it-hub/

- https://www.linkedin.com/pulse/2021-guide-global-talent-sourcing-5-countries-excel-robin-dekker/?trk=public_profile_article_view

- https://www.oysterhr.com/library/top-cities-for-tech-talent

- https://www.pwc.com/vn/en/media/media-articles/180122_dautu_bpo_dtqv_en.pdf

- https://www.skuad.io/blog/15-countries-companies-should-target-for-hiring-their-next-tech-talent

- https://www.thedialogue.org/analysis/can-latin-america-meet-the-demand-for-tech-talent/

- https://www.trade.gov/country-commercial-guides/chile-information-technologies

- https://youteam.io/blog/software-development-outsourcing-to-chile/