The State of The Ukrainian Tech Labor Market Late Q1 2024

The current state of the Ukrainian Tech Segment’s labor market can best be described as being at a standstill. Nearly all sectors within the Ukrainian tech industry are in a ‘wait-and-see’ phase, largely due to prolonged and complex discussions in government and parliament regarding mobilization legislation and its potential impacts.

Additionally, the government’s hesitation to establish clear mobilization reservation procedures has further constrained tech companies’ ability to hire. Consequently, international corporations with branches in Ukraine, including companies like Microsoft, have decided to pause all hiring activities in Ukraine until further clarity is achieved.

What’s Going on with Current Salary Trends?

Due to numerous external factors, salary dynamics of the Ukrainian Tech Industry are experiencing a significant slowdown.

The main reasons include the short-long-term unpredictability of the situation, uncertainty regarding government regulations (including ambiguous tax reform and decisive lack of vision concerning mobilization and specialist reservation), and investors’ reluctance to fully invest in an unstable economy with unclear “rules of the game.”

For the most part, any salary growth in Ukrainian Tech was neutered by the ever-increasing cost of living and inflation (National Bank of Ukraine projects 9,8% inflation by the end of 2024). As a result, even though nominal salary figures are technically higher, its purchasing power is lower than the corresponding figures from late 2021.

In addition, the salary range has broadened considerably during 2023 due to the influx of career switchers into the tech industry. As a result, salary ranges for junior and to some extent for middle-level talent have widened.

- Junior talent’s average salary range width from minimum to maximum average – $2000

- Middle talent average salary range width from minimum to maximum average – $2750

Domain-wise, there were a couple of salary growth spikes here and there during late 2023 and early 2024:

-

- Artificial Intelligence and Machine Learning startups across multiple domains (namely DefenseTech, EduTech, HealthTech, IoT, MarTech, HRTech, and Big Data) had intermittent 25-40% salary growth for Cloud Engineers (especially Azure), ML Engineers and Solution Architects (with an extra boost for OpenAI-related stacks), and DevOps, among others due to the company’s fast scaling hiring sprees.

- It is important to note that the hiring activity is comparably lower than in other Ukrainian Tech niches.

- However, none of that activity has developed into a full-fledged trend, as most AI-related startups still struggle to establish functional business models. As a result, these companies find long-term employee retention challenging.

- The salary growth is mostly for senior, senior+, and lead talent, while middle and junior talent salaries don’t get the AI hype salary spike.

- Embedded software is gradually becoming the most consistently growing niche within Ukrainian Tech due to its broad scope of implementation and consumption (including military/defense, consumer electronics, and manufacturing).

- As a result, the salary dynamics showcase a consistent growth trend of 10-20% for embedded developers and engineers with Embedded-C and Embedded Linux for stacks for UDP, RTSP, and RTMP tools.

- The core demand for embedded software talent is currently in drones and electronic warfare solutions.

- Team leads are in extra high demand due to talent scarcity. Because of that, upon recruitment, such talent can negotiate up to a 35% raise.

- Cybersecurity is another industry segment that got an interest spike by the end of the year. However, the interest in cybersecurity solutions and hiring high-profile cybersec talent has gradually grown since at least Q3 2022, with salary dynamics moving in small nudges of 2-5% per quarter across the board for penetration testers, vulnerability assessors, security engineers and architects, IT auditors and the likes.

- Q1 2024 saw a considerable interest spike in cybersec talent, with salary offers going as high as $8000 for high-profile certified cybersec engineer/architect talent.

- In addition, cybersecurity companies are getting more and more queries for IT security audits and long-term cybersecurity consultancies. Consequently, this also affects salaries for IT auditors and consultants, with an average check growing by 35-40%.

- Artificial Intelligence and Machine Learning startups across multiple domains (namely DefenseTech, EduTech, HealthTech, IoT, MarTech, HRTech, and Big Data) had intermittent 25-40% salary growth for Cloud Engineers (especially Azure), ML Engineers and Solution Architects (with an extra boost for OpenAI-related stacks), and DevOps, among others due to the company’s fast scaling hiring sprees.

- Fintech and banking niches have consistent talent demand that overlaps with other domains (such as cybersecurity and big data). That said, salary growth patterns need to be more consistent and mainly relate to senior-senior+-lead level tech talent.

- Throughout 2023, fintech and fintech-related positions saw an average increase of 25%. At the same time, banking positions saw an average growth of 20%.

-

- However, regarding cybersecurity-related positions in banking, there was a 30% growth during Q4 2023 and Q1 2024 compared to Q4 2022 and Q1 2023.

Overall, there’s a bit of lull going into Q2 2024. Long Term employees still have relatively high salary levels. At the same time, new hires generally veer in two opposite directions:

- High profile tech talent can negotiate themselves a 20-35% higher salary, especially for in-demand positions in AI and Cybersecurity fields.

- As for mid-level talents – the average salary level is slowly decreasing due to an influx of junior talent from 2021 and 2022 that increases the talent pool depth but also justifies hiring less expensive talent.

Let’s look at some Q1 2024 high points:

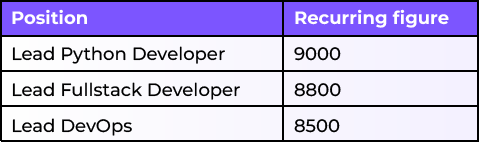

Highest Recurring Salary

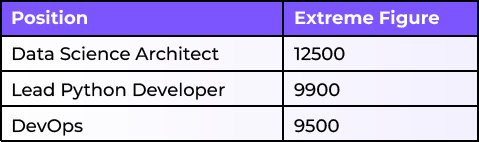

Highest Extreme Salaries

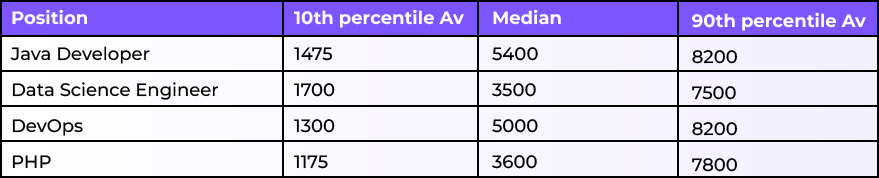

Most Dynamic Salaries (from Junior to Lead levels)

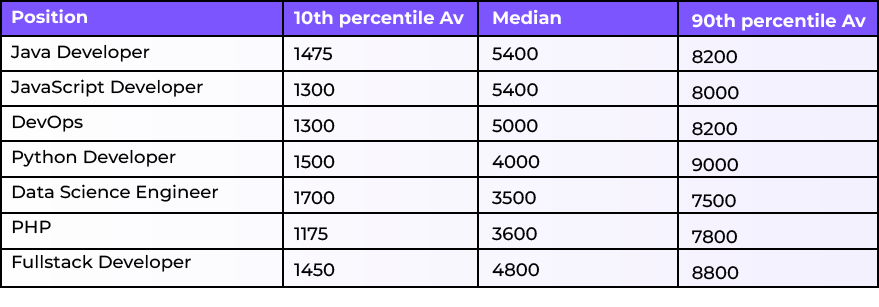

Most In-Demand position salaries (from Junior to Lead levels)

What Will Happen with the Salary Levels Q2 2024 Onwards?

Given the current economic situation and existing business challenges – it is highly unlikely that Ukrainian tech talent salary growth can be considered actual growth and not just higher figures with lower purchasing power.

If we look at year-over-year technical specialists’ salary growth patterns for 2020-2021 – there’s consistent 15-23% average median growth across the board for junior and middle levels and 18-29% for senior\senior+ talent.

However, 2022-2023 showcased a substantial slowdown – 9-16% average median growth across the board for junior and middle levels and 12-17% for senior\senior+ talent.

Since there were no substantial changes in the economic situation during late 2023 early 2024 – it is fair to assume that there will be a further median decrease at a similar rate.

Entering 2024, the Ukrainian tech segment is at a crossroads.

- The operation within the Ukrainian market is becoming increasingly more challenging – clients are hesitant to deal with companies due to the war and mobilization and other inconsistent government policies add its own set of business challenges that don’t make things easier.

Business relocation and a bigger focus on foreign markets are viable solutions in this situation.

However, the increasing integration into foreign markets via local offices has a catch.

Due to the martial law male citizen travel ban – there are limited options for relocating Ukrainian talent to foreign offices, which generates the need to find talent on-site. The longer this situation goes on – the more it will affect the Ukrainian labor market and contribute to tech talents’ gradual salary level decrease.

What’s Going on with the Talent Demand?

Java Developer

- Java developer salary dynamics haven’t changed drastically from Q4 2023.

- Big Data, finance (partially including crypto), web\mobile applications niches currently drive the demand for Java developers (as of early 2024 and early 2024)

- Junior-level positions experience a gradual minimal decrease (15% from Q4 2023) and a slight maximum increase (18% from Q4 to Q1).

- Depending on the niche, middle-level salaries remain at Q4 2023 levels. Outsourcing middle Java experienced a 15% decrease, while fintech middle Java had a 19% increase.

- Senior-level talent got a 15% minimal decrease and an 18% maximum salary increase.

JavaScript Developer

- SaaS web-based applications and online gaming currently drive the demand for JavaScript developers.

- The talent pool of junior and middle-level talent gets thinner regarding senior-senior+ talent.

- Minimal salary levels for junior and middle talent slowly decrease while maximum levels remain unchanged. The difference from Q1 2023 to Q1 2024 is 22%.

- Senior talent salary dynamics continue Q4 2023 with notable exceptions for the fintech niche. Maximum levels jump up and down 15%. However, there’s a minimal level of 10-15% decrease.

DevOps

- Highly segmented talent pool with numerous domain and niche-specific expertise variations.

- The demand comes from across most Ukrainian Tech niches – FinTech, Cybersec, ML\AI, DefenseTech, SaaS, Big Data, etc (including domain-specific DevOps variations like FinOps, DevSecOps, CloudOps, etc).

- Outsourcing companies hire juniors and middle talent en masse, but since the hiring scope had shrunk considerably during Q4 2023 and Q1 2024, there are not many hires. This trend results in a gradual lowering of the junior minimal salaries. During Q4, the decrease trend was 13%.

- Fintech companies consistently hire middle and senior DevOps talent, especially with cybersecurity profiles. Fintech companies also have the highest salaries in the tech segment. The difference for DevOps across the board averages 15-20%.

FullStack

- Swiss army man of the development process. There is a high demand for a wide variety of consumer applications.

- An influx of junior talent significantly lowers the minimal salary levels. Q4 2023 to Q1 2024 saw a 15% decrease. While senior salary levels increased 12% on average during the same period

- At the same time, middle and senior ranges had widened. The minimal levels had decreased by 10-15%, while the maximum levels saw little growth.

- In the case of fintech Full Stack, there was 5-10% growth for senior+ talent. But since the demand is significantly lower than before, that won’t develop into a trend soon.

- The Lead-level talent pool is relatively scarce and hard to engage with. Due to high salaries, they only engage if the offer is about a challenging project with exceeding benefits and career progression.

Python Developer

- The core demand is among machine learning-related projects – including natural language processing and generation, computer vision, voice\sound recognition, and data analysis.

- Salary-wise, AI/ML companies currently provide the highest salaries for Python talent. The difference between an ML startup\product Python and an outsourcing Python developer’s salary can reach 25% as of Q1 2024.

- Hyped-up artificial intelligence startups also pay big money to hire high-profile Python talent. Companies sometimes pay 20-30% higher than the market average.

- At the same time, market oversaturation with junior talent caused a crawling minimal salary level decrease. Q4 2023 to Q1 2024, the minimal salary level decrease for junior and middle talent has been 10%. Maximum salary levels remain more or less at Q1 levels.

- Senior and lead talent are steadily in demand. Because of that, there was no significant salary range up and downs during Q4 2023 and Q1 2024.

Data Science Engineer

- Continuously growing big data implementation across various domains combined with R&D and outsourcing demand drives the talent demand.

- The current data science talent pool includes switchers from other development fields. The core segment is middle-level talent.

- There is a shallow talent pool for seniors with significant talent scarcity for senior+ and lead-level talent.

- There is an intermittent 10-20% range increase for Big Data and Artificial Intelligence-related positions, especially those related to cloud computing (for machine learning models) and data engineering.

PHP

- Consistent demand across multiple domains and niches (web applications, websites, CRMs, anything interactive). Outsourcing companies carry a significant portion of the talent demand.

- The talent pool is diverse, with a growing number of incoming junior talent and a core segment of middle-level talent. The pool gets progressively shallower when it comes to senior-level talent.

- The thing is – there’s a skill gap between the product company definition of PHP senior/senior+ and the outsourcing definition of a senior/senior+ PHP developer. Salary-wise, the difference for product and outsourcing senior PHP is 25% on average during late 2023 and 10-15% for senior+ talent.

Talend Demand Factors Explained

There are 5 significant factors affecting Ukrainian Tech salary dynamics from Q1 2024 onwards.

1 Competition for talent scales down

- 2022 and part of 2023 saw a substantial increase in unemployed specialists and switchers from other domains, considerably diluting talent demand and shifting the initiative towards employers.

- As a result, companies now have more opportunities to make more cost-effective hiring decisions, i.e., hiring talent for lower salaries.

- The balance shift in the labor market allowed companies to change gears in the recruitment process. As of late Q1 2024, when it comes to hiring a qualified specialist – companies want to be sure that’s the right person for the job.

- In the current market situation, companies can take their time to hire high-profile tech talent, but the talent mostly can’t. As a result, companies can take a firmer position on the salary levels they offer.

2 Salary freezes and decreases are becoming more common, and retention is becoming less of a priority.

- The unpredictable market situation due to war combined with the global economic crisis and recession perpetuates Ukrainian tech companies’ complicated state of affairs.

- The biggest challenge is decreasing investor interest due to war. As a result, there is less money to spend and fewer resources for scaling.

- The maximum salary level growth more or less slowed down to a crawl during Q4 2023 coming into Q1 2024, with minor (up to 10%) fluctuations for in-demand positions. At the same time, new hires showcase a slight decrease in maximum levels with 15-20% drops.

- However, lack of salary growth perpetuates the possibility of having troubles with the employee’s long-term retention.

- Sooner or later, the more the extended salary freeze goes on, the more employees will be willing to consider other job opportunities with higher salaries and better benefits packages.

- Retention is much less of a priority than in 2021, when companies would casually bust a hefty counteroffer to keep the talent away from competitors.

- Talent retention remains an option for a high-profile senior-senior+ and lead talent, but companies won’t go out of their way to retain junior or middle talent. During our 2023 research cycle, we have documented only a handful of retention case studies with an average salary raise of 15% for senior-senior+ specialists.

3 An influx of job seekers dilutes the talent pool

- Q4 2023 and Q1 2024 saw candidate activity growth on job boards and social media.

- Some talent is employed but looking for a better job. Some tech talent was either let go or laid off due to the company’s financial situation or reorganization and now needs to find a new job as soon as possible.

- But there’s a catch. There are not enough jobs for everyone on the market. As a result, the influx of job seekers also alleviates the talent scarcity that scales down the competition for talent. That’s the reality for in-demand positions like Python, Java, JavaScript, and C#.

- Some companies saw an opportunity to hire unemployed tech talent with lower salaries. The average decrease is 20-25%, but there are also cases with salary decreases as low as 50%.

- In some cases, candidates usually interested in full-time work now also consider working part-time or hourly employment because of job opportunity scarcity.

4 More cost-effective hiring with many juniors

- The sheer volume of incoming junior talent slowly pulls down the minimal salary levels for junior and middle levels. During Q3-Q4 2023, the decrease was around 12% compared to Q1 2023. During Q1 2024 the decrease slowed down to 10%.

- The growth of these two categories contributes to the long-term solution of the talent scarcity problem.

- But as a side-effect, emerging tech talent also slightly pulls down the salary levels and, over time, levels the field.

- However, the detrimental effect is alleviated by a growing preference for in-house talent upskilling from the junior level onwards.

5 Seasoned professionals make no sudden moves

- Due to the highly unpredictable and volatile market situation, a significant segment of high-profile senior/senior+/lead talent hesitates to change jobs. Our 2023 annual research cycle shows that the number of respondents willing to change jobs due to higher salary offers is down 20% from the 2022 cycle.

- It doesn’t mean high-profile specialists are content with their current employment. Salary freezes, lack of raises, lack of bonuses, and other cutbacks take their toll. The volatile market situation creates a long-term retention problem for the companies.

- Concurrently, while the motivation to change jobs for better opportunities is still present among tech talent, it is not like a high-profile specialist will jump on board if you give him a nice enough job offer.

What Will Affect the Ukrainian Tech Segment During Q2 2024 Onwards?

The Ukrainian Tech Industry going into Q2 2024 continues the trends showcased during Q4 2023 and Q1 2024.

- Numerous external factors continue to affect the industry and obstruct productive business dealings. Recession holds back business scaling and attracting substantive investments, continuing invasion scares off potential outsourcing clients;

- There’s an overall significant industry slowdown. Companies scale back their recruitment operation for more cost-effective long-term approaches;

- Several niche hypes came and went – artificial intelligence deep learning projects, data science, autonomous vehicles (drones, etc), and smart gadgets.

- Government regulations remain inconsistent; maintaining existing clients and gaining new ones is still hard.

- Cybersecurity, both in the private and government sectors, remains a controversial topic.

- Gambling and online gaming niches remain questionable despite their massive whitewashing marketing efforts.

As a result, companies try to balance between the following goals:

- keeping the existing team intact;

- hiring high-profile specialists where it counts;

- attracting newbies for a cost-effective workforce.

There are also several recruitment challenges related to mobilization and employee reservation:

- a significant segment of bigger Ukrainian tech companies (100-200+ onwards) applies staff employment instead of a hybrid private entrepreneur contractor model.

- However, due to mobilization regulations, companies must update their employee listings and request employee reservations for selected employees.

- Because of fear of mobilization, numerous candidates expressed a lack of interest in employment as company staff. Instead, they prefer staying on the private entrepreneur hybrid employment model or switching entirely to unofficial employment.

- The gray area companies (Adtech, gambling kinds) actively use this candidate concern to their benefit, offering competitive salaries without the paperwork hassle.